The August 26 budget hearing conducted by the USD 469 Lansing school board was loaded with deception and subterfuge, seemingly intended to convince the public that a large property tax hike is necessary. The shenanigans came not from board members but from Superintendent Marty Kobza.

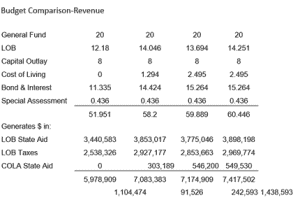

First, he showed the board a Budget Comparison-Revenue schedule, shown adjacently, saying the first column has the revenue-neural rates, and columns 2-4 are proposed mill increase scenarios.

Kobza told the board that his schedule shows that going from 51.951 mills at revenue-neutral to 58.2 mills would generate $1,104,474 in additional state aid to the district. However, he did not say that he was not showing the revenue-neutral rates provided by the Leavenworth County Clerk. The variances are sufficiently significant to suggest that rates were manipulated to understate the amount of property tax and state aid the district would receive for operating expenditures (LOB and Cost of Living) at revenue-neutral.

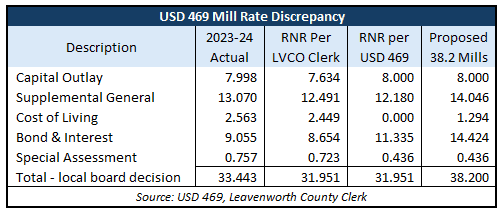

For example, his schedule shows RNR for the Local Option Budget at 12.18, but the real rate, according to the County Clerk, is 12.491. The revenue-neutral rate for Capital Outlay is 7.634, but the schedule says it is 8.000. The Cost of Living rate should be 2.449, but Kobza shows it at zero. Bond & Interest should be 8.654, not 11.335, and Special Assessment should be 0.723, not 0.436.

The incremental revenue to the district at 38.2 mills (not counting the state-mandated 20 mills for state funding) would be much less had Kobza used the real revenue-neutral mill rates. Cost of Living state aid would not be zero as Kobza shows, but about $511,000. Kobza’s schedule also understates the LOB state aid at revenue-neutral by excluding the Cost of Living factor and using an arbitrary amount for an adopted LOB in the budget forms.

Debt service cash flow analysis is missing in action

Kobza told the board the district would not be able to make its debt service payments for bonds and interest by 2029 without a large increase in the mill rate, but he provided no documentation to support his claim. The Sentinel asked Kobza to share his calculations and explain many other discrepancies in his presentation, but he did not respond.

It’s possible that the bond rate may need to be increased, partly because Kobza convinced the board to reduce it last year rather than reduce other levies and necessitate operating a little more efficiently. Some board members are resisting tax increases this year, but Kobza said the district would have to cut 15 teachers to reduce the operating budget by $1 million without a tax increase.

We also asked Kobza why he would propose cutting teachers instead of many other options, such as:

- USD 469 had two assistant principals in 2005 and now has six.

- Administration spending is up 33% since 2021.

- Transportation is 121% higher than in 2021.

Again, Kobza won’t respond.

Kobza is entitled to his opinion, but he should make his case for a tax increase without attempts to manipulate the board. School board members are entitled to and should demand no less than the unadulterated truth and full disclosure of the calculations behind every recommendation. Approving a budget with anything less is a disservice to students and parents.