New Leavenworth Superintendent Dr. Kellen Adams posted a recent video to justify the proposal for USD 453 to exceed the Revenue Neutral Rate (RNR) for the 2023-24 school year, but was Adams not entirely forthcoming in his presentation.

Dr. Adams claimed at one point: “Last year, the Leavenworth board of education voted for a budget reduction…”

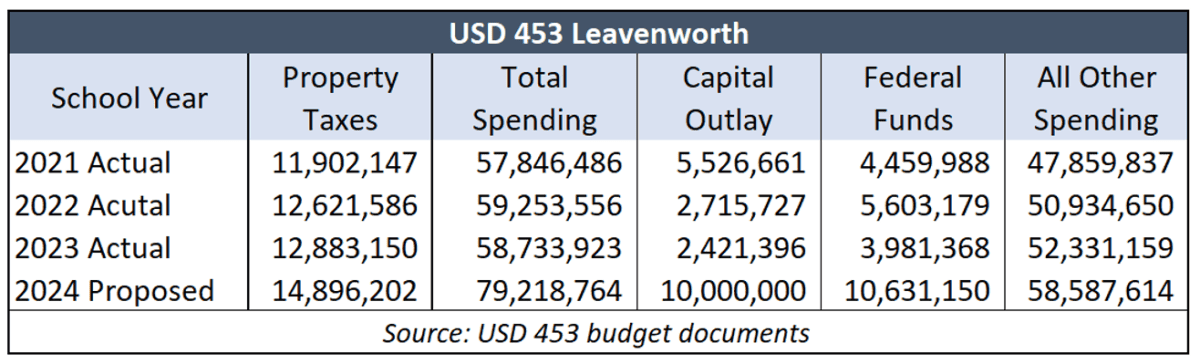

While technically true, it was not caused by holdinig property tax flat as Adams implies. As the table below shows, it was because the district had less in federal aid, according to the district budget documents. The total budget decline was about $500,000 but federal funds dropped by $1.6 million. Had federal funds not declined, the district would have spent $1.1 million more even though it didn’t raise property tax. (Capital Outlay declined by about $300,000 but that was by the district’s choice; it could have dipped into the $9 million in Capital Outlay cash reserves it held and spent the same as the previous year.)

Dr. Adams declared in another instance: “That budget collected $876,000 less in local property taxes, which resulted in missing out on an additional $481,000 in state aid.”

In reality, the same table shows last year the district collected about $261,000 more in property tax. Dropping the Capital Outlay mill rate by about 4 mills did reduce state equalization capital outlay aid, but the district arguably did not need that money. It began the year with $9.6 million in Capital Outlay cash reserves; the district spent $2.4 million and collected $1.1 million in property tax, so should still have about $9.3 million in Capital Outlay cash reserves.

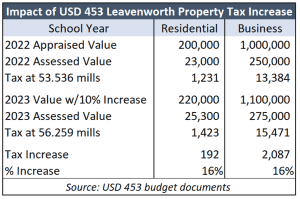

Dr. Adams also said that the proposed tax increase will cost the owner of a $200,000 home just $62 this year. But the real cost is much higher.

Homes are assessed at 11.5% of appraised value, and one mill in property tax costs $1 for each $1,000 of assessed value. Last year’s mill levy of 53.536 therefore would cost the homewner $1,231 in school property tax. If the assessed value of that home jumped 10% this year (which could be even more), that person would pay $1,423 in school property tax next year. That is a 16% increase overall. The district doesn’t set appraised values, but it’s actions contributed to a 16% property tax increase, and that is the burden facing the homeowner.

USD 453 will hold its public hearing to discuss its upcoming budget on Monday, September 11th.