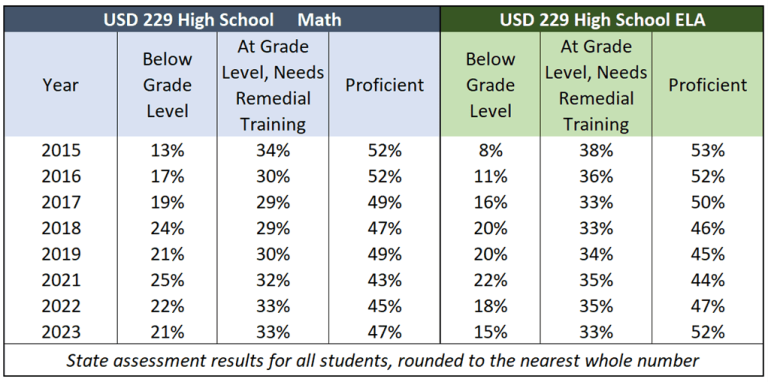

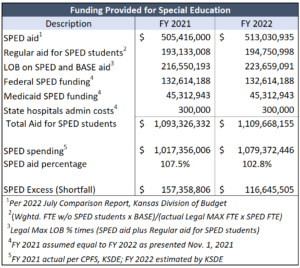

School funding advocates met at the Capitol in Topeka recently to make the case that special education in Kansas is underfunded. But other testimony presented shows the Legislature’s funding exceeds schools’ spending.

State law requires that Kansas pay 92% of “excess costs,” which is determined by subtracting total spending from federal funding.

According to the Kansas Association of School Boards, the state only pays about 77% of excess costs, and the shortfall is about $160 million.

Those numbers are misleading, however, as the formula in state statute does not account for various “weightings” for which special ed students are eligible. Weightings are additional funds for things like transportation, bilingual instruction, or at-risk students.

According to testimony from Dave Trabert, CEO of the Kansas Policy Institute — which owns the Sentinel — if base state aid, weightings and associated local option funding are added to the federal funding, special education funding in FY 2021 exceeded spending by $157 million.

“FY 2021 spending is the sum of (1) actual spending in the Special Education and Co-Op Special Education funds in the KSDE online database less payments made to Co-Ops and Interlocals, and (2) Interlocal spending provided by KSDE,” Trabert said. “It should be noted that Interlocal spending is not published by KSDE and amounted to $236 million in FY 2021. FY 2022 spending is not yet available, so we used the KSDE estimate presented in November, 2021.

“On this basis, schools received $157 million more aid than was spent on special education in FY 2021, and $117 million more in FY 2022.”

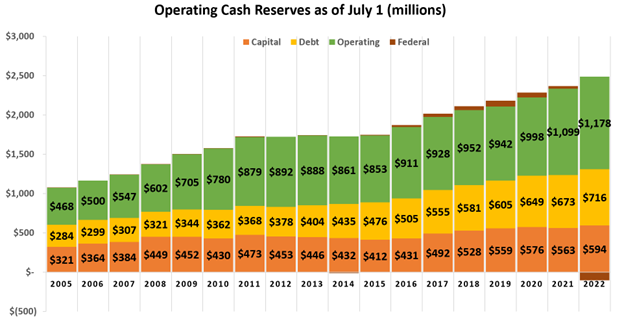

Operating reserves at record levels

Moreover, while claiming to be underfunded, school districts have increased their operating reserves by about $180 million over the last two years to nearly $1.2 billion. Special Ed reserves, included in operating reserve totals, went from $221 million to $245 million over the same period.

Operating reserves are total cash reserves less federal funds and those for capital outlay and debt services.

“At the very least, an increase in operating cash reserves indicates that school district operations were not negatively impacted by getting less special education aid than they believe is required,” Trabert said. “Changes in annual fund balances are like those in checking accounts; balances increase when more money is deposited than is spent.”

Special education accounting needs attention

According to Trabert, there are indications that school accounting practices should be audited for accuracy.

“Our review of special education spending for FY 2021 shows there is good reason for a Legislative Post Audit to ensure that other education expenditures are not charged to special education,” Trabert said.

KPI found such examples as:

- $1.1 million in utility bills charged to special education by districts.

- Over $45 million for Administration (General Administration, School Administration, and Central Services).

- The Sedwick County Interlocal charged $5.5 million to ‘Other.’’

- KSDE says payments to Special Education Co-Ops and Interlocals don’t count as expenditures because it would be double-booking when the receiving entity spends the money. However, $5.6 million labeled Interagency Purchased Services could be double-booked.

- $51 million for Contracting of Bus Service, with most of the spending attributed to ten districts.

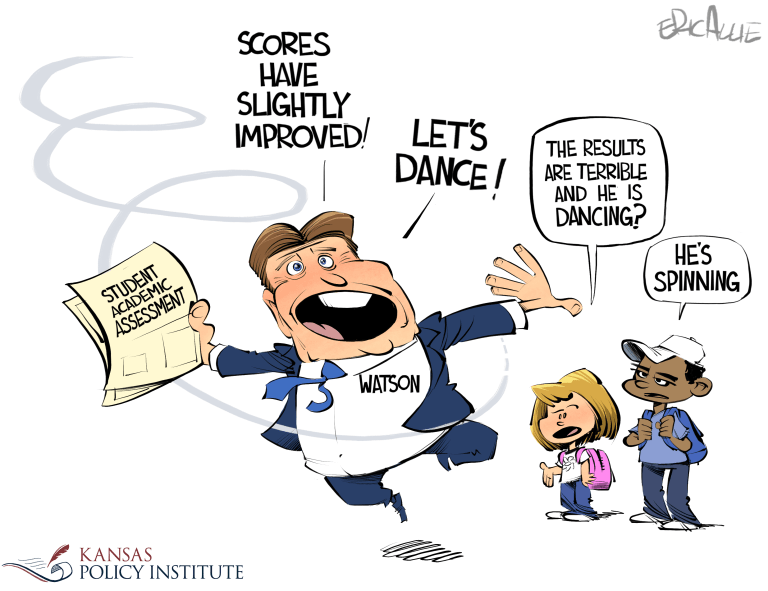

“Our examination of the facts indicates there is no shortfall in school funding for special education or general education,” Trabert said. “Many students may not be getting the education they deserve, but it is not for a lack of funding.

“We encourage the Legislature to amend the special education formula so that all money is counted. We also recommend a Legislative Post Audit to ensure proper accounting of all special education expenditures.”